Morgan Stanley Wealth Management Cio Lisa Shalett joins the Barrons Round Table to analyze current market prospects for investors after the job report.

Markets are increasingly pricing on the chances of Federal reserve Reducing interest rates at its next meeting in September after the weaker than the job report last week.

The Fed’s Hand, the Federal Open Market Committee (FOMC), decided to reduce interest rates to all five meetings this year, including last week, as stubborn Inflation remained higher than 2% the purpose of the Central Bank and Tariffs are the threat of impetus to inflation higher.

Although inflation has not yet decreased under this threshold, the market sees that the Fed’s detention model is over when the next interest rate announced on September 17th.

According to the CME Fedwatch tool, the market now sees 90.4% Fed’s probability of reducing interest rates by 25-base points after its next meeting-63.3% a week ago and 64% last month.

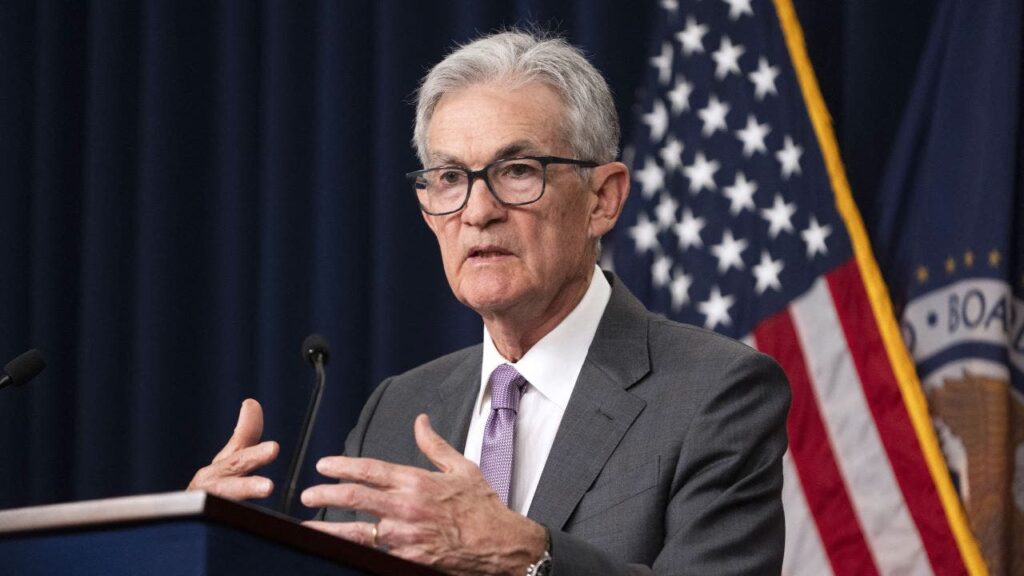

Federal Reserve Chairman Jerome Powell said the Central Bank is able to respond to a deterioration in the labor market or an increase in inflation. (Roberto Schmidt / AFP Via / Getty Images)

The changes come after FOMC held a stable meeting last July last week.

Federal reserve chairman Jerome Powell He said the labor market was “wide in balance and in accordance with maximum employment”.

He also noted that the evidence suggests that US companies and consumers pay the bigger part of Tariff costsAnd not foreign exporters who reduce their prices to report tariffs.

Trump packed Powell as a “moron” and calls on the Fed’s board to take control of policy movements

Federal reserve governors Michel Bauman and Christopher Waller disagreed with the most FOMC solution, claiming that the Fed should reduce the percentage by 25 basic points. (Ann Sapphire / Photo / Reuters)

Powell said the central bank is well positioned to answer any worsening of economic conditionsAnd the market took its comments to be relatively nuclei for inflation. Following the announcement, the chance of reducing the September rate decreased from 63.3% to 47.3% on Wednesday.

Last week, the Fed’s Fed Inflation Manometer, the Personal Consumption Index (PCE), also appeared, which shows that PCE’s title inflation increased to 2.6% in June, compared to 2.3% in May. The main inflation of PCE, which excludes the volatile prices of food and energy, also marks higher than 2.7% to 2.8%.

Fed’s preferred inflationary gauge shows that consumer prices have risen again in June

The market addresses that news by reducing the likelihood of a reduction in the September course, as the likelihood of reduction decreases from 46.7% to 39%, according to the CME Fedwatch tool after the news.

Thehe July report on work He was released on Friday and entered the added 73,000 jobs – well under 110,000 estimates of economists surveyed by LSEG. It also contains more than normal revisions that left employment in May and June a lower with 258,000 jobs.

Get Fox Business on the go by clicking here

The percentage reduction ratios were collected after a weak job report, with the CME Fedwatch tool showing a jump of 37.7% to 73.6% of the news.

2025-08-05 16:04:31

https://a57.foxnews.com/static.foxbusiness.com/foxbusiness.com/content/uploads/2024/08/0/0/Jerome-Powell-press-conference.jpg?ve=1&tl=1