You would think that about half of the stocks in the S&P 500 do better than average in a given year. A balanced distribution between outperformers and underperformers in the market can be expected.

The reality is that the exact percentage moves up and down in real time. And generally speaking, only about 20% of S&P 500 constituents beat the market average. That’s why finding a winner is such a big deal.

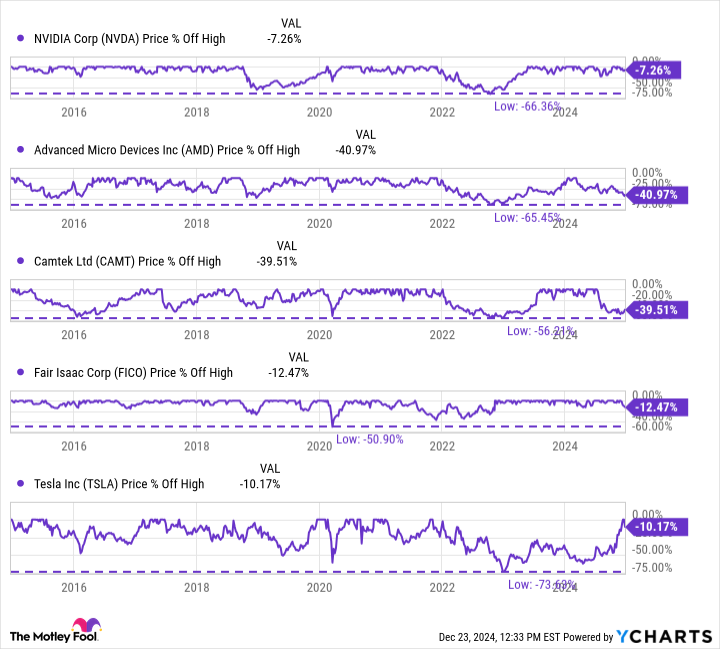

According to MacroTrends, the top five stocks of the past decade are Nvidia (NASDAQ: NVDA), AMD (NASDAQ: AMD), Camtek (NASDAQ: CAMT), Honest Isaac (NYSE: FICO)and Tesla (NASDAQ:TSLA). These shares have compound annual growth rates between 40% and 75%. At the bottom end, a $10,000 investment in Tesla 10 years ago is worth $290,000 today. After all, a $10,000 investment in Nvidia back then is worth almost $2.7 million now.

A key component of The investment philosophy of The Motley Fool is to “allow your portfolio winners to keep winning.” There are relatively few winners, and if you have a winner in your portfolio and sell it prematurely, you have about an 80% chance of replacing it with a loser.

Sounds simple, right? Just buy good stocks and hold on to the big winners. But in reality, Nvidia, AMD, Camtek, Fair Isaac, and Tesla all share one surprising thing that has made it extremely difficult to keep up with them over the past decade.

Over the past 10 years, these five stocks have fallen 50% or more in value at least once. Tesla is back more than 70% from its 10-year high. And even the mighty Nvidia is down 66% in 2022.

Nvidia has actually fallen 50% or more on two separate occasions in the past decade. Tesla did it three times. So is AMD, if we round the numbers slightly, and it’s currently down 40% from the highs it hit earlier this year.

NVDA data from YCharts.

When a stock falls this far, there will always be negative headlines fueling long-term fears. And these bearish cases will scare investors into believing that the time to sell has come.

On the one hand, it’s easy to sympathize with someone who has sold out. Imagine having a position worth hundreds of thousands of dollars that drops 50%. It would make you sick to your stomach to watch such a large profit disappear. But on the other hand, selling any of these five stocks after a 50% pullback ended up being the wrong move, causing the sellers to miss out on huge profits.

The great investor Charlie Munger said: “If you are not willing to react coolly to a 50% drop in the market price two or three times a century, you are not fit to be an ordinary shareholder, and you deserve the mediocre performance you have. We will be compared to people who really have a temperament that can be more philosophical about these market fluctuations.”

2024-12-26 14:05:00

https://media.zenfs.com/en/motleyfool.com/59e422ab74c933fa0a6ae4832aaf7f98