(Bloomberg) — A landmark year for U.S. stocks is ending badly, as a retreat in technology shares extended a losing streak that began when the Federal Reserve cooled expectations of a rate cut two weeks ago.

Most Read by Bloomberg

The S&P 500 fell as much as 1.7 percent on Monday — the third time the index fell more than 1 percent in eight sessions — before paring losses. Technology stocks including Apple Inc., Microsoft Corp. and Broadcom Inc. weighed on the stock index.

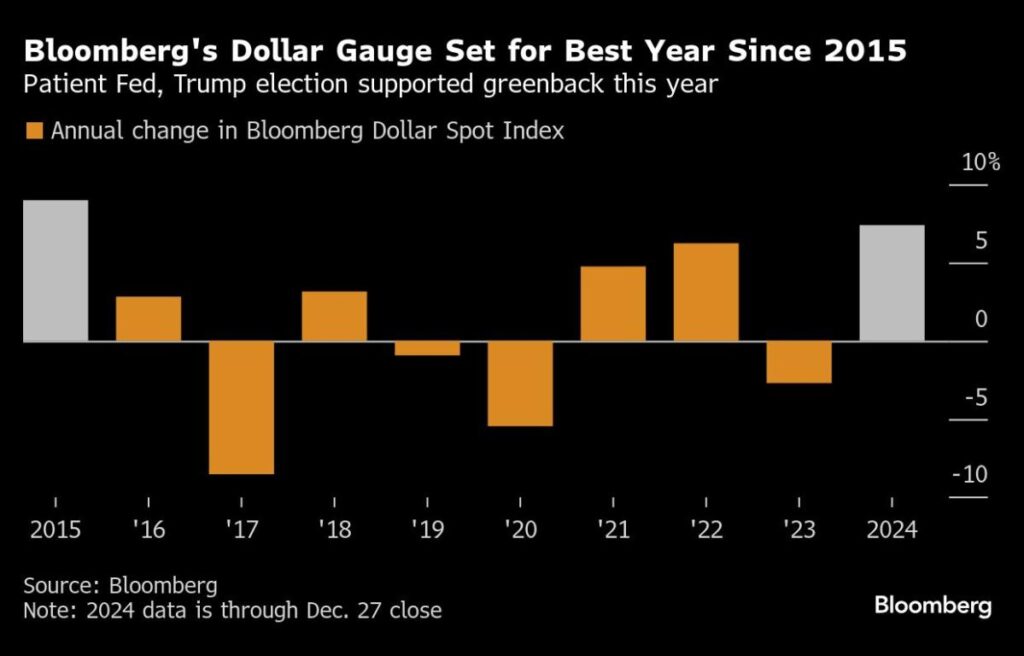

Treasuries rose, with the 10-year yield hovering around 4.55%. Yields had fallen further after data from the Chicago Purchasing Managers’ Index showed an unexpected decline. Monday’s data also showed pending U.S. home sales rose for a fourth month in November to the highest level since early 2023. The Bloomberg Dollar Spot index rose to its highest level since November 2022.

This year, the so-called Magnificent Seven cohort of U.S. tech giants led the S&P 500 to a 25% advance, while prompting some to worry that gains were too concentrated in a small group of names. Still, few are calling for the rally to end, and none of the 19 strategists tracked by Bloomberg expect the S&P 500 to decline next year.

“At these times, it’s best to stay put,” said Nicolas Domont, a fund manager at Optigestion in Paris. “The United States remains the place to be. Growth stocks continue to outperform and earnings forecasts are good, so there are good reasons to remain bullish.”

Elsewhere, Europe’s Stoxx 600 edged lower, while Asian shares posted a five-day gain. Trading volumes were weaker due to the festive season.

“There is a bit of anxiety heading into the end of the year, due in part to uncertainty about how the international trade picture might shape up in 2025,” said Tim Waterer, chief market analyst at Kohle Capital Markets Pty. “Some traders are taking risk off the table towards the end of the year.”

This is the last session for 2024. for some markets, including Germany, where the DAX benchmark saw a 19% annual advance.

Fatal accident

In Asia, shares of Jeju Air fell 8.7 percent in Seoul to a record low after a Boeing Co. A 737-800 operated by the carrier crashed on Sunday, killing all but two of the 181 passengers. Boeing shares fell as much as 5.9 percent in U.S. trading before easing.

Oil rose as traders focused on risks to 2025. Crude oil is headed for a loss this year, with trading confined to a narrow range since mid-October. Gold is in for one of its best years.

2024-12-30 17:02:33

https://s.yimg.com/ny/api/res/1.2/2s8uXch3U8WKLh_JbDSDDA–/YXBwaWQ9aGlnaGxhbmRlcjt3PTEyMDA7aD03Njg-/https://media.zenfs.com/en/bloomberg_markets_842/f73c76a8fe7fb1de462189520c613fa1