(Bloomberg) — Emerging market stocks rose on Tuesday, as the main gauge of stocks made a final push for the year on the back of an Asian tech rally and signs that China is preparing to unleash more stimulus.

Most Read by Bloomberg

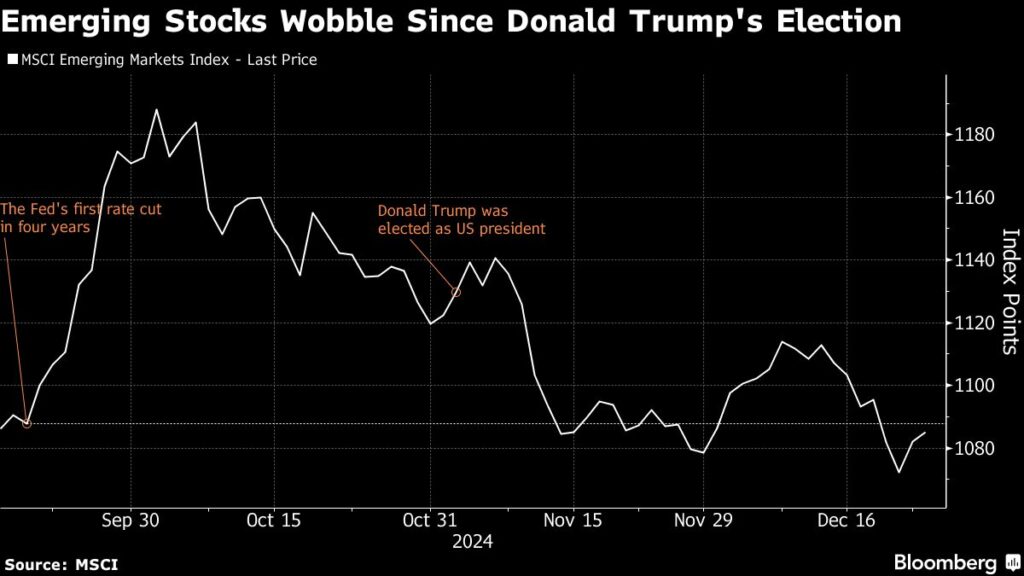

MSCI’s benchmark index of emerging-market shares rose for a second day in light pre-holiday trading, supported by a 1 percent rise in Chinese shares. While it has targeted a total return of around 9%, it still has significantly underperformed developed-market stocks, which have returned more than 20% so far this year.

MSCI’s gauge of emerging currencies fell for a second session. The index is hovering around its lowest level since August and is on course for a 0.5% loss this year. Meanwhile, government and corporate dollar bonds from emerging markets have returned about 7% in 2024, according to a Bloomberg index.

A number of headwinds are looming for developing nations, including threats to increase tariffs from President-elect Donald Trump, geopolitical tensions and signs of sticky inflation. However, some investors remain optimistic.

The year “2025 will bring volatility again, especially when Trump officially comes to power, but EM companies have very solid fundamentals that will help them navigate this uncertain environment,” said Arnaud Bue, senior fixed income portfolio manager at Bank Julius Baer in Zurich. “Net leverage is very low for investment grade, but high yield companies and default expectations are also very low.”

On a positive note, Chinese markets got a boost from a Reuters report that policymakers plan to sell a record three trillion yuan ($411 billion) in special government bonds in 2025 to shore up the slowing economy. Chinese shares rallied, bringing gains for the year to more than 16%.

Asian technology stocks also extended their recent rally, as Taiwan Semiconductor Manufacturing Co. hit a record high, putting the world’s largest contract chip maker on track for its best annual stock performance in 25 years. Shares rose as much as 1.4% on Tuesday before erasing the gains to end flat. Shares of Alibaba Group Holding Ltd. also jumped 2.7%.

The Colombian peso rose 1% as the best performer among emerging currencies, while the South African rand was a notable laggard with a 0.6% decline. South Korea’s won was undermined by weak consumer confidence data as well as the opposition party’s promise to start impeachment proceedings against acting President Han Duk-soo.

2024-12-24 18:56:05

https://media.zenfs.com/en/bloomberg_markets_842/73ce5654df41430cf829195b79db3dca